Strategy

We insure market participants against unlikely events (‘tail risks’) in regulated equity markets. This is implemented by selling put and call options on liquid stock indices, such as the AEX and the EUROSTOXX 50.

We receive a premium for the risk we take. We maximize this premium within our investment mandate based on our econometric risk models.

We manage our risk through a rigorous risk management system that we have developed over more than 20 years.

The positions we take are always short-term. We secure our profit (premium) by letting the insurance expire, or by ‘rolling over’ the insurance to the next period.

We repeat the above steps for each period, which is typically between 20 and 45 days.

Performance

Our target is an average annual net return for investors of 6%-10% after fees and costs. The Fund’s strategy shows a long-term stable net return of 8.0% per annum after fees and costs over the period 2018-2025*. The AEX, including dividends, returned 9.9% during this period. A savings account yielded around 0.6%.

* Apple Tree Fund was formally founded on 18 December 2020, but detailed investment data has been recorded since March 2018. For the calculation of the average net return per annum over the period 2018 – 2025, the realized return of March-December for 2018 has been used, which is a conservative approach of the net returns for 2018. In April 2025, the announcement of the tariff-war by the American president, and the subsequent sharp reaction on the financial markets, resulted in a substantial loss. After the event, the Fund’s risk management framework has been upgraded to improve manageability of large market shocks (see more under ‘Risk Management’). Past performance does not guarantee future results. There is a risk of negative returns. How we manage that risk, we have described below.

Risk Category

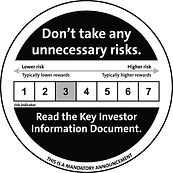

European Union (EU) laws and regulations oblige investment funds to determine a risk classification (1 = low risk, 7 = high risk), supervised in The Netherlands by the Authorities for Financial Markets (AFM). It applies standardized methodologies that no fund can deviate from to calculate the fund's risk category.

Apple Tree Fund has risk category 3 (medium-low risk), following the standardized EU risk classification for funds.

Risk Management

We understand that investing in derivatives can be seen as risky. The core of our strategy has long been used by options traders and investment professionals. Our position is a result of our risk management system that we have developed, based on econometric models and clear risk indicators. Strict rules, no emotions, no exceptions.

Our investments are made on the basis of predefined criteria and safety measures with capital preservation as the starting point. We then optimize profits to match our desired level of risk. Finally, we monitor global financial markets and geo-political developments with a potential impact on our positions. Our risk system dictates how we should handle that information.

The Fund’s risk framework is updated on a continuous basis with new data points from the market. For example, after the atypical market reaction to the American president’s new tariffs in April 2025, several improvements and updates have been incorporated in the risk framework, with a focus on how to react on (similar) strong price movements. This has further improved the strategy’s resilience to market shocks and reduces the risk of large losses in the Fund.

We apply our risk framework to protect our investors’ capital. But we are also supervised ourselves, by an independent Depositary that protects the interests of Apple Tree Fund investors. In addition, the Depositary is the legal owner of the Fund’s assets invested by the investors. We, the Fund Manager, only have access to these assets for the purpose of managing them within our mandate.

Even a professional risk management system does not prevent all risks. An investment in the Fund involves financial opportunities, but also financial risks associated with investing in general and investing in derivatives in particular. That means it is possible that the investment in the Fund will increase in value, but it is also possible that the investment in the Fund will generate little or no income and that all or part of the investment in the Fund will be lost. On this website, and in more detail, in the Information Memorandum, we explain the risks that exist and how we manage them, and we are happy to further explain this in person.

Costs & Transparency

We use a simple fee structure. Investors pay 2.40% per year. There are no entry and exit fees, no performance fees, no fine print.

In terms of costs, investors only pay the transaction costs for the contracts the Fund concludes. These depend on the number of transactions that may take place in an investment period. The transaction costs are not known in advance and are difficult to project because of the volatility of these costs, meaning that the costs can fluctuate significantly during the month. However, higher transaction costs usually go hand in hand with higher returns. For more information, please refer to the section 'Fees and costs' in the Information Memorandum (IM) and to the Key Information Document (KID), which can be downloaded below in the ‘Downloads’ section.

This is it. Plain and clear. Just as we are clear about the results. Investors receive a monthly report with information about their investments, including their capital development, with monthly and cumulative results over the entire investment period. Additionally, an annual report is issued that can be used for tax returns.

Downloads